In a world that’s rapidly evolving, one thing is clear: cashless transactions and contactless payments are quickly becoming the new norm in India. This paradigm shift is driven by a convergence of factors, including the government’s enthusiastic push towards digital payments, the flourishing e-commerce sector, and the transformative impact of the COVID-19 pandemic.

Current Landscape

As of January 2023, digital transactions in India have soared to an impressive 803.6 crore, boasting a total value of ₹12.98 lakh crore. These figures represent a remarkable year-on-year growth of 69% in volume and 53% in value.

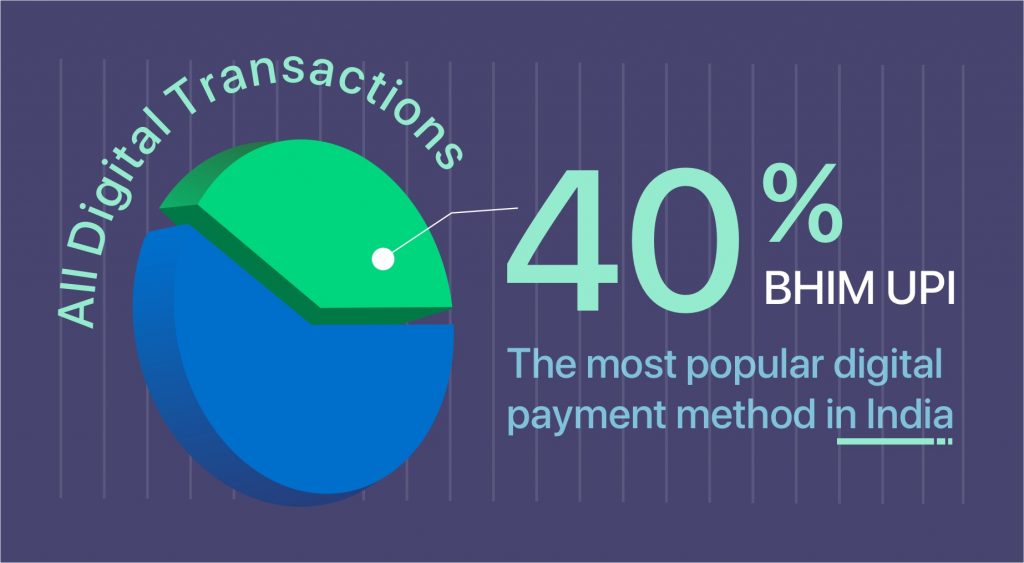

Notably, the **BHIM UPI (Unified Payments Interface)** stands out as the most popular digital payment method in India, commanding a commanding share of over 40% of all digital transactions.

But it’s not just digital transactions that are on the rise. Contactless payments are also gaining significant traction in the country. Between December 2018 and December 2021, there was a staggering six-fold increase in the number of contactless transactions.

Recent Trends

Recent statistics underscore the rapid evolution of payment methods in India. A report by Worldline India reveals that contactless payments accounted for a notable 16% of all card transactions in December 2021, a significant jump from the mere 2.5% recorded in December 2018. Additionally, a study conducted by Visa found that a whopping 67% of Indian merchants now accept contactless payments.

Further underlining this digital transformation, the Reserve Bank of India’s Digital Payments Index (DPI) for March 2023 reached an impressive 305.52. This signifies a remarkable surge in the adoption of digital payments across the nation.

Driving Factors

Several key drivers have fuelled the remarkable growth of cashless and contactless payments in India:

- Government Initiatives

The Indian government has spearheaded a slew of initiatives aimed at promoting digital payments. These include the trailblazing Digital India program, the user-friendly BHIM UPI app, and the highly successful RuPay card scheme.

- Rise of E-commerce

The e-commerce sector’s phenomenal growth has played a pivotal role in driving cashless transactions. Virtually all online merchants now accept digital payments, making it more convenient for consumers.

- COVID-19 Pandemic

The onset of the COVID-19 pandemic acted as an unexpected catalyst, accelerating the adoption of cashless and contactless payments. With health and safety concerns at the forefront, people increasingly sought ways to minimize contact with physical currency.

Benefits

The advantages of cashless and contactless payments are manifold:

- Convenience

These payment methods offer unparalleled convenience. Payments can be swiftly and effortlessly executed via smartphones or cards, eliminating the need to carry cash.

- Security

Cashless and contactless payments are significantly more secure than cash transactions. The risk of theft or loss is greatly reduced.

- Transparency

These methods provide transparent records of transactions, facilitating budgeting and accounting processes.

- Financial Inclusion

Cashless and contactless payments have the potential to promote financial inclusion, bringing more individuals into the formal financial system.

Challenges

Despite the remarkable growth, there are still challenges to overcome:

- Lack of Awareness

Many individuals, particularly in rural areas, remain unaware of the benefits associated with cashless and contactless payments.

- Limited Infrastructure

While the number of merchants accepting digital payments is growing, there are still pockets, especially in smaller towns and villages, where digital payment infrastructure is limited.

- Security Concerns

Some people harbor reservations about using cashless and contactless payments, citing concerns over security.

Conclusion

Cashless transactions and contactless payments are undeniably becoming the new norm in India. Driven by government initiatives, the burgeoning e-commerce sector, and the lessons learned from the COVID-19 pandemic, their adoption is set to continue surging. India is rightfully proud of this Tezi Bharat (Fast India) journey in digital finance. While challenges remain, the future promises a more efficient, secure, and inclusive financial landscape for all Indians. Embracing these innovative payment methods is not just a trend; it’s a step towards a more connected and digitized future.

Leave a Reply